Dive into our research and tactical guidance on how credit specialists can make better use of data to optimize loan size, price, and eligibility.

Limited time? Download it here to save for later.

Contents

Introduction and research methodology

Insight 1: Demand for capital among merchants is high

Insight 2: Low offers deter merchants from accepting capital

Insight 3: Newer merchants aren’t necessarily less creditworthy

Strategies for scaling merchant capital offerings

Tactic 1: Optimizing loan offers using accurate revenue calculations

Tactic 2: Analyzing spend to decrease risk and lower price

Tactic 3: Expand eligibility by pre-qualifying new-to-platform merchants

Introduction and research methodology

With a loyal audience of many thousands of merchants, payment providers hold a strategic advantage in the business lending space. They have an existing, trusted relationship with customers, access to verified merchant income data, and the ability to collect repayments directly via processed transactions to mitigate default risk.

Despite this, the dozens of payment providers we speak to tell us that they struggle to scale their merchant capital programs.

To uncover the most effective tactics to grow merchant capital offerings (also known as merchant cash advance), Codat surveyed 350 US merchants about their appetite for taking capital from their payment provider. The research covered SMBs from 0-1,000 employees and was carried out via Attest, a leading research platform.

Insight 1: Demand for capital among merchants is high

Within the sample surveyed, 60% of respondents said they were fairly likely or very likely to apply for credit within the next 12 months. The most common reason for wanting credit was to invest in the business (45%), followed by help with general cash flow (36%). The most common amount they wanted to borrow was between $50-100K (22%), followed by $250-500k (16%)

?Key takeaway: When payment companies experience low take rates for capital offers, it’s not simply a case of a lack of want or need for credit. There are likely other factors at play related to the capital proposition and its presentation.

Insight 2: Low offers deter merchants from accepting capital

When it comes to declining a loan offer from a payment provider, the top reasons are clear:

- Not needing capital at that time (40%)

- Reluctance to borrow in the current climate (27%)

- Lack of trust in the brand (24%)

- High cost (23%)

- The amount offered was too low (22%). For merchants with revenue above $1 million, this jumps to 31.7%.

Interestingly, factors like high effort, lengthy processing times, or fears of rejection do not significantly impact the decision-making process when it comes to loan offers. This sets payment providers apart from other credit providers in this respect.

? Key takeaway: Increasing the size of the loan offered could positively impact take rates of capital.

Insight 3: Newer merchants aren’t necessarily less creditworthy

37% of those surveyed said they had started using one of their payment providers within the last 6 months. 18% said they had started using a payment provider within the last 3 months.

Payment providers may assume that new-to-platform merchants are recent upstarts with low or inconsistent revenue. This can lead to restrictions on accessing capital for merchants who have recently joined the platform.

Our research challenges this assumption. Within the cohort of merchants who had recently started using a new payment provider (within the last 6 months), 41% had an annual turnover exceeding $1 million.

? Key takeaway: Finding ways to prequalify new-to-platform merchants could significantly increase the pool of creditworthy merchants open to capital offers.

Strategies for scaling merchant capital offerings

From this research, it’s clear that there is an opportunity for payment providers to more effectively scale capital offerings, by optimizing pricing, the size of the loan offered, as well as finding a way to extend capital to new to platform merchants without compromising on risk. The next section offers tactical advice on how off-platform data can be used to achieve these goals.

Tactic 1: Optimizing loan offers using accurate revenue calculations

Payment providers typically base their capital offers on internal platform data, often capturing just a proportion of a merchant’s total revenue (e.g. 10-20% of annual revenue). Our data indicates that providers could be overlooking more than 50% of a merchant’s income, leading to a mismatch between the merchant’s expectations and the offer they receive. Leveraging external financial data enables payment providers to:

1. Collect customers’ bank statements

2. Enrich bank transactions with categorization

3. Break down revenue by channels

We dig into the details below.

1. Collect customers’ bank statements

Access to merchants’ bank data allows providers to gain a more accurate understanding of their total income. How the request for data is positioned is critical to maximizing conversion. Additional research by Codat reveals that 67% of small and medium-sized businesses are open to sharing their data if offered a clear incentive.

Our advice is to present a pre-qualified offer based solely on your platform data to reduce obstacles for merchants. Then, pair this with a clear call to action to increase the offer by linking the merchant’s bank account.

2. Enriching bank transactions with categorization

As banking data generally includes just the payment date, amount, description, and merchant name, it can be of limited utility to underwriters unless supplemented with the categories of spend and income that are typically seen on financial statements.

Codat’s approach to bank transaction categorization helps merchant capital lenders improve the accuracy of the data they’re using, so they can more confidently automate their data processing to get insight into applicants’ cash flow. It categorizes transactions into a hierarchy of levels, from Level 1, which gives the most high-level category (e.g., expense), to Level 5, which provides the most granular detail (e.g., client entertainment).

To learn more about how our bank transaction categorization engine works, click here.

3. Break down revenue by channels

Introducing multiple data sources into the underwriting process can pose a challenge for merchant capital lenders in understanding their share of the wallet. Codat alleviates this obstacle by enhancing payment processor information, facilitating a clear understanding of revenue distribution across channels.

By aggregating revenue per channel, merchant capital providers gain insights into their share of the wallet. This knowledge allows them to adjust loan offers based on additional revenue streams visible or leverage it as a risk indicator to enhance the terms presented to the merchant. Codat offers the convenience of automating this process through the API or downloading the data for detailed analysis in Excel.

Tactic 2: Analyzing spend to decrease risk and lower price

Relying solely on payment processing data for underwriting leaves credit teams in the dark about a merchant’s spending habits, making it hard to determine how much they can afford to repay monthly. This gap in visibility increases the probability of default, which providers mitigate by increasing the cost of funding for the merchant.

The issue with this approach is that small businesses are particularly cost-sensitive, and numerous lenders compete on price to serve them. Therefore, as the research earlier in this guide underlines, an uncompetitive rate is one of the leading factors causing merchants to reject a loan offer.

By understanding operating profit and outstanding debt, payment providers can better assess repayment capacity and offer lower rates to lower-risk merchants. This can be achieved with the following steps:

1. Building a cash-based P&L

2. Analyzing outstanding debt

We dig into the details below.

1. Building a cash-based P&L

To establish a cash-based Profit & Loss statement, start by guiding the merchant to connect their bank account. Then, leverage a provider like Codat to enrich the bank transactions with spend and income categories.

Using either an API or Excel, aggregate the totals for each category over a specific period, like the previous year. From this view, providers can understand the profit margin on an annual and month-by-month basis. Merchants meeting a certain profit margin threshold could qualify for a lower, more competitive rate.

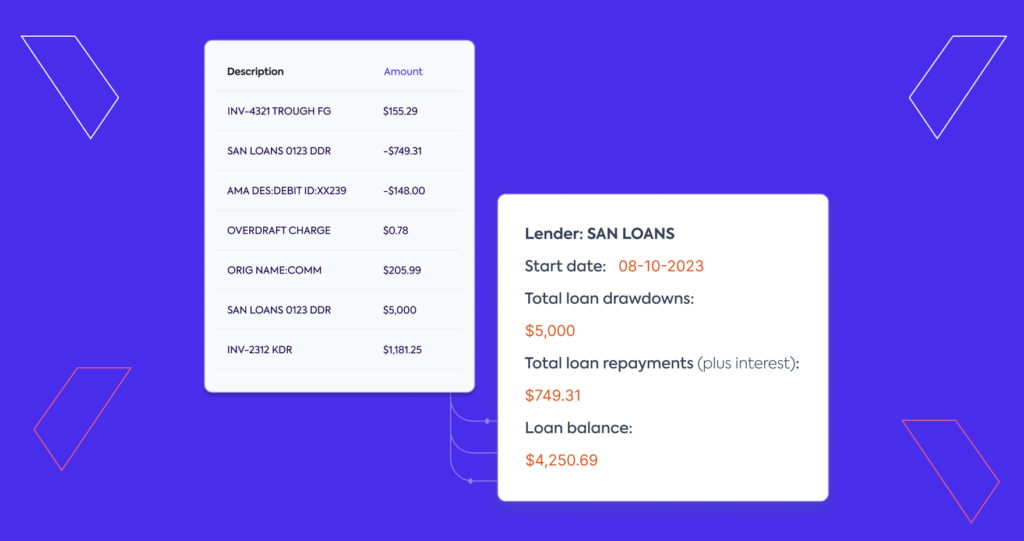

2. Analyzing outstanding debt

Additional debt obligations are a critical indicator of increased risk. To analyze outstanding debt with Codat, providers can either drill into the ‘financing category’ of the cash-based profit and loss, which breaks down the totals for drawdowns and repayments, or they can use the loan report feature, which summarizes each loan’s provider, start date, total repayments, and remaining balance.

If providers can confirm that the merchant does not have any additional debt obligations, they may use this as a ‘low-risk indicator’ and choose to improve the rate offered to that merchant, increasing the chances of acceptance.

More on understanding merchants’ loan capacity here.

Tactic 3: Expand eligibility by pre-qualifying new-to-platform merchants

The common practice of limiting capital offers to merchants with at least 6 months of processing history on the platform not only limits the pool of eligibility but can also act as a barrier to customer acquisition if the merchant is reliant on capital previous provider. By offering capital from the outset, payment providers can establish a significant competitive edge, enticing a greater number of merchants to make the switch.

This can be achieved with the following steps:

1. Invite prospects to connect their data during the onboarding process

2. Invite new merchants to connect their data to see if they qualify for capital

We dig into the details below.

1. Invite prospects to connect their data during the onboarding process

Where sales teams initiate the onboarding process, a simple link to connect banking, accounting, and/or previous payment processing data can be shared with the merchant as part of the onboarding pack or in an email. As a bonus, the same data can be used to inform the general merchant onboarding risk assessment, as it includes information like historical transaction volumes and chargeback history. As a bonus, the same data can be used to inform the general merchant onboarding risk assessment, as it includes information such as historical transaction volumes and chargeback history.

2. Invite new merchants to connect their data to see if they qualify for capital

Showing merchants a pre-qualified offer is a proven strategy for driving uptake of capital because it gives the merchant more confidence that their application will be successful. However, only offering capital that can be pre-qualified based on their payment processing history unnecessarily limits the pool of eligibility.

To avoid this, is, providers can use a simple banner within the portal or an email campaign to invite new merchants to connect their bank accounts and see if they qualify for capital.

Connecting the bank account tends to be the lowest friction dataset to collect. It can be used in the same way as payment processing data to understand revenue to calculate a potential offer. As described in tactic 1, Codat enriches banking data with the payment processor for each transaction, so that providers can easily access a summary of revenue by channel.

Conclusion

Our research underscores a significant opportunity for payment providers to amplify their merchant capital offerings. While the demand for capital among merchants is strong, challenges such as low loan offers, high costs, and restrictive eligibility criteria currently hinder uptake. To overcome these barriers, payment providers should employ the following tactics:

- Integrate external financial data: Expand data collection to off-platform sources to include bank statements and other financial documents. This will provide a more complete picture of merchant revenue, enabling more accurate and appealing loan offers.

- Utilize enriched transaction data: Analyze enriched transaction data to understand merchant spending patterns and reduce default risks. This deeper insight allows for more competitive and tailored lending rates.

- Broaden eligibility criteria: Extend capital offers to new merchants by leveraging comprehensive financial histories. By evaluating banking, accounting, and previous payment processing data, providers can differentiate themselves from competitors and attract a larger merchant base.

By embracing these recommendations, payment providers can drive greater satisfaction, increase loan uptake, and achieve more sustainable growth in their lending programs. These strategies will not only meet merchants’ current needs but also position providers for long-term success in a highly competitive lending market.

To learn how Codat can help you reach your goals, simply fill out the form below and connect with one of our data experts.